CBN Directive on N500b Capital Base Sparks Potential Bank Mergers

A Significant increase in the minimum capital requirements for all banks operating in the country was yesterday announced by the Central Bank of Nigeria (CBN).

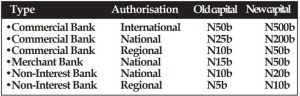

Acting Director, Corporate Communications, Mrs. Hakama Sidi-Ali, listed requirements for the various categories of banks in a circular.

The step marks a turning point in Nigeria’s banking history.

Banks are expected to play a significant role in the attainment of the $1 trillion economy projection of the Bola Ahmed Tinubu Administration.

In the circular, the minimum capital base for banks with international authorisation has been raised to N500 billion from N50 billion.

The minimum capital base of N25 billion for commercial banks with national authorisation has been raised to N200 billion (translating to an eight-fold increase).

Banks with regional authorisation have been mandated in the circular to raise their minimum capital base from N10 billion to N50 billion.

The circular pegged the minimum capital requirement for merchant banks at N50 billion.

Non-interest banks with national and regional authorisations now have minimum capital requirements of N20 billion and N10 billion respectively.

The circular states that the new requirements will come into effect on April 1, 2024, with a two-year window for compliance.