Senators voiced their concerns about the new Central Bank of Nigeria (CBN) regulation on cash withdrawals yesterday, stating that it will cause many businesses to fail in the nation.

The new withdrawal policy announced on Tuesday by the apex bank set weekly limits of N100,000 and N500,000 for the maximum amount of cash that could be withdrawn over the counter (OTC) by both individuals and business organisations. Additionally, it has set a daily cap of N20,000 on individual Point of Service (PoS) withdrawals.

The CBN announced the policy’s implementation date as January 9, 2023, in a circular titled “Naira Redesign Policy – Revised Cash Withdrawal.”

When seconding a resolution to refer the nominations of Mrs. Aishah Ahmad and Mr. Edward Lametek Adamu as CBN Deputy Governors to the committee for review, Senate Minority Leader Phillip Aduda (PDP, FCT) brought the new policy to the attention of his colleagues.

Aduda urged caution regarding the cash withdrawal cap, claiming that the rule will harm the economy of the nation.

“Our economy cannot withstand this shock, in my opinion, and neither is our trade.

People are hurting, and it is a really important subject, so we need to talk about it, he said.

Senator Gabriel Suswam (PDP, Benue) agreed with Aduda’s assertions and urged the Senate to discuss the policy right away for the sake of Nigerians, who, he claimed, were very concerned.

“Calls from residents who work outside of the formal sector flooded my phone. People are quite concerned. For the benefit of Nigerians, you ought to have permitted us to address this matter, he remarked.

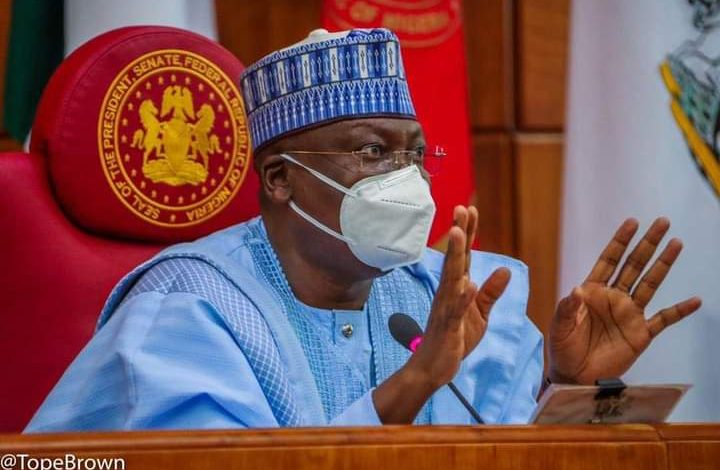

We cannot quickly go cashless, says Lawan

Senate President Ahmad Lawan warned the CBN not to implement the policy immediately in his remarks during the session, claiming that many Nigerians will be impacted.

He added that the National Assembly should contact the CBN to find out more information about the policy.

He instructed the Senate Committee on Banking, Insurance, and Other Financial Institutions to address the issue during the CBN Deputy Governors’ screening as a result.

Lawan also promised that a detailed discussion of the new policy would take place on Tuesday.

These two deputy governors have worked for the CBN for the previous four years, I will advise at this time. They therefore comprise this system. They are not fresh faces.

When they show up for screening, this ought to be one of the important points that is brought up.

“I want to make sure we are adequately informed and led. The vast majority of us, if not all of us, have never interacted with that institution.

“In my view, if we want to transition to a cashless society, we should do it gradually rather than all at once. The majority of Nigerians will be out of work.

But we must take advantage of the screening to become more knowledgeable about the policies, he added.

A variety of Point of Service (PoS) operators in Abuja who were interviewed claimed that, if the strategy were to be put into effect, it would force them out of business.

An operator named Kingsley Mbah said that the policy would lower his daily profit.

“They want to take our POS job away from us since we don’t have anything else to do. When we go to the bank, I may withdraw up to N400,000, manage it when people arrive for withdrawals, and earn up to N5,000 every day.

There is no way we can generate such a profit under this rule. The most I can make is N2,000 or N1,500, none of which will meet my necessities, he claimed.

Michael Emma, a different operator, remarked: “Let them (CBN) do their adjustments and let us be. This legislation will have an impact on the youth who make up the majority of PoS operators, which may cause us to reevaluate our attitudes toward crime. Daily withdrawals of N20,000 are not feasible. I personally conduct more than 100,000 transactions per day. It won’t aid in our work, he declared.

The Conference of Nigerian Political Parties (CNPP), however, has defended the initiative, claiming that the detractors are omitting the policy’s major benefits, particularly in light of the upcoming general elections in 2023.

The CNPP stated in a statement released by its Secretary-General, Willy Ezugwu, yesterday: “Nigerians are suffering today as a result of poor administration, and any sacrifice made to ensure that the proper leadership assumes power starting in 2023 is worthwhile.

“Nigeria’s broken election systems over the years, which hurled bad and corrupt politicians on the populace, are to blame for lousy governance. This developed as a result of heavily funded electoral systems.

“However, any method that will lessen the influence of crooked politicians and moneybags in Nigerian politics is worth whatever sacrifices are required from the general populace, who suffer the most from poor administration.

“Second, material in the public domain demonstrates how many millions, if not billions, of naira notes were tampered with and rendered useless where the nation’s thieving leaders stashed the money, depriving the economy, especially the banks, of the liquidity needed for productive industry.

Poor fiscal policies have been implemented in the nation over time as a result of the wrong people holding public office as a result of an electoral system that detests fair elections.